We are driven by curiosity. We have a penchant for seeking out new experience, original knowledge and candid feedback. Read this section for our thoughts, our insights, and a few opinions.

July 2004 Market Outlook

As we near the end of July, most major indices are showing negative returns for the year. The S&P 500 is down1 2%, US small caps, as measured by the Russell 2000 are down 2%, while the NASDAQ is off 7%. In Canada, the S&P/TSX is up 1%, while small caps, as measured by the S&P/TSX SCI, are down 7%. Globally, the MSCI EAFE is flat while the Japanese Nikkei is ahead 6%. Bonds are essentially unchanged with US 10-year Treasury yield having risen from 4.3% to 4.5%. In looking at commodities, Gold is down 7%, while Oil, as measured by West Texas Intermediate Crude, is ahead 41%.

In our last newsletter [Hillsdale 2004 Market Outlook – January 2004], we noted that after a strong rally in 2003 there were many issues that might abridge the current rally including; the ongoing wars in Iraq and Afghanistan, the twin US deficits, a rise in short or long term rates, a return of inflation or the continued depreciation of the US dollar. Since the beginning of the year, each seems to have contributed to the market’s turmoil at one point or another. Looking forward, we are most focused on the issues of rising rates and a potential return of inflation.

At its April meeting, the Federal Reserve, while not raising rates, signalled an important policy shift by noting it would no longer be ‘patient’ but rather it would be invoking ‘measured’ increases. The Fed followed through at their June meeting by raising rates 25 basis points. Its first increase in more than four years, lifting the yield to 1.25% from 1.0%. Although the rate is still at multi-decade lows, the era of super-cheap money seems to be nearing its end. While US and Canadian markets did not react to the June rate change, they did react to the Fed’s April announcement and also to a higher headline inflation number by selling off approximately 5%. Since the beginning of May, markets have been unable to recover from this drawdown. Fed Funds futures are indicating a rate of 2.0% by year end and most economists indicate that a neutral rate would be between 3.0% and 4.0%, which many believe is a reasonable forecast for 2005 year end. At these levels, cash will continue to offer low returns.

Equity Valuations versus Cash

From a valuation perspective, many analysts, especially those in the bearish camp, have argued that valuations have to return to levels seen at previous market bottoms before equities can be deemed to offer reasonable value. We find this argument to be incomplete mainly because it does not assess valuations in context to other alternatives.

As we noted in a previous commentary [Hillsdale Market Outlook – March 2003]:

“From a valuation perspective, much has been made of S&P 500 trailing P/E level of 18 [since] this is higher than any previous market bottom. Following the 1990 recession, the P/E was 12, after the October 1987 crash, the P/E was 14 and after the 1982 recession the P/E was 7. However, at these points in time, cash was yielding 7.4%, 6.4% and 12.6% respectively [and] bonds were yielding 8.8%, 9.5% and 10.5% during those same periods. If cash rates were at those levels today, we would say the market is expensive.“

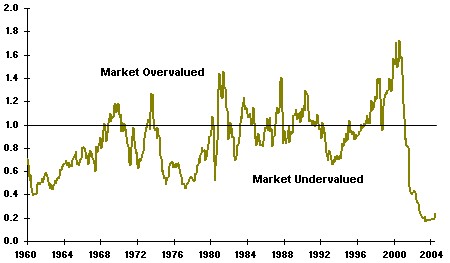

Today, US T-bills are yielding 1.34% and the P/E on US stocks is 18. To put this relationship in context, we take the current cash yield and divide it by the current earnings yield for stocks, which today is 5.6%2. When the two rates are equal, the market is generally fairly valued, when the ratio is below one, stocks are typically undervalued and when the ratio is above one, stocks are typically overvalued. As the graph below notes, the cash yield to earnings yield ratio is at 0.23 and is still at its lowest level by far when compared to any time period over the past forty years.

US Equity Risk Premium vs. T-bill (Using S&P 500 Earnings Yield)

Source: The Federal Reserve, Ford Investor Services

Going back to the late 1960s, of the eight worst peak to trough drawdowns, all but one have occurred when this ratio was greater than 1.0. In other words, the market has only once experienced a period of stress when this ratio was below 1.0 and that was in 1977.

If rates were to follow the forecast level and reach 2.0% by year-end and assuming the multiple stays at 18, then this ratio would move towards 0.4. For 2005, if rates rise towards 4.0% and assuming the multiple expands to 20, this ratio would move to 0.8 which would place it within its normal historic range.

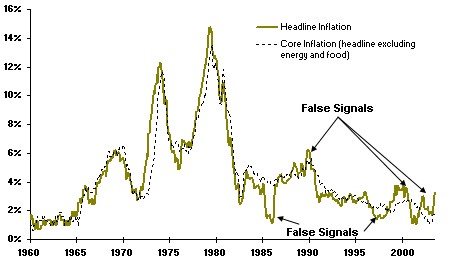

Also working against T-bills is that when adjusted for inflation, cash continues to yield negative real returns given that the headline inflation number for June was 3.3%. This compares to 2.1% a year ago. Arguably though, from a forecasting or asset allocation perspective, core inflation (excluding the volatile energy and food components), which came in at 1.9% for June versus 1.5% a year ago, is a better figure to use since it is more stable and less susceptible to short term swings. As the graph below notes, core inflation closely tracked the headline number in the late 1960s and through the 1970s when inflation spiked to record levels.

US Inflation: Headline vs. Core

Source: US Department of Labor, Bureau of Labor Statistics

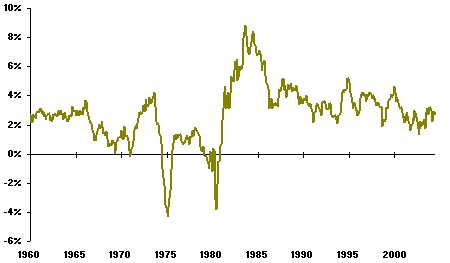

But during 1986, 1991, 1998, 2000 and 2002 when the headline figure gave false signals, the core number remained unaffected. Today, with the spread between the headline and the core numbers again widening, it remains to be seen whether the headline figure is undertaking a sixth false signal or if it truly portends a secular change in inflation. In studying the bond markets, which generally suffer much more than stocks during periods of inflation, real returns based on core inflation seem remarkably stable. As the graph below illustrates, real bond returns have been between 2-4% for the past 12 years and there has been no noticeable change for the last few quarters.

Source: Global Financial Data

Core inflation is running at levels last seen in the 1960s and it appears to be the number that both the Fed and the bond market are currently following. Nonetheless, cash yields, whether measured in real or nominal terms, continue to offer little in the way of competition when viewed against the earnings yield available from equities.

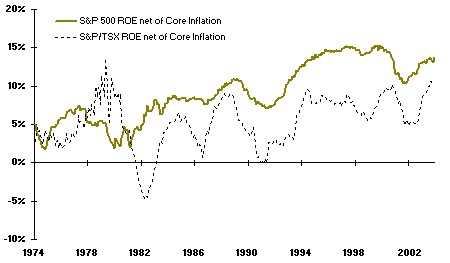

Equity Valuations versus Inflation

When assessing the longer term outlook, it is also necessary to analyze valuations in context to equity profitability. For the S&P 500, the current ROE is 16%. As the graph below notes, when adjusted for core inflation, real ROE is around 14% in the US and around 10% in Canada. Both are at the higher end of their historic ranges.

US and Canadian Return on Equity Net of Core Inflation

Source: Ford Investor Services Inc., CIBC

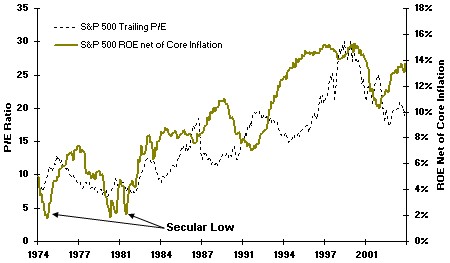

As the next graph shows, secular lows in P/E multiples are accompanied by secular lows in real levels of ROE.

US Real ROE versus Trailing P/E

Source: Ford Investor Services Inc.

During the 1970s, real ROE averaged in the low single digits and so did the P/E multiple. During the 1980s, real ROE ranged between 7% and 10% and the P/E multiple moved between 10 and 15. During the 1990s, real ROE averaged around 12% and the P/E multiple ranged between 15 and 20 (excluding the mania levels of 1998/99). For the current decade, real ROE has averaged around 12% and the P/E multiple has returned to a level just below 20. If real ROE maintains its current trend level, then a P/E multiple between 15 to 20 seems reasonable.

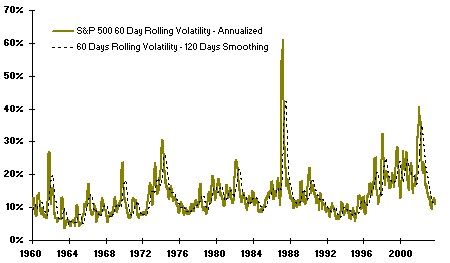

In looking at the shorter term picture, despite the uncertainty associated with rising rates, potentially higher inflation and the wild card surrounding the terror threat, the markets remain surprisingly sanguine. As the graph below illustrates, volatility has remained at low levels.

S&P 500 Daily Price Volatility

Source: Reuters, Hillsdale Investment Management Inc.

Volatility, currently trending at 12%, is at its historic median level and well below levels experienced during the bubble era. Future volatility as measured by the Market Volatility Index (VIX) is currently sitting at eight year lows. It is encouraging to note that markets may to be returning to a more normal and stable trading pattern.

In summary, the lacklustre outlook for ‘safe’ assets held in cash and money market instruments continue to make stocks appealing and suggests that current equity valuation levels are reasonable. Inflation, though rising, is coming from very low levels and it is far too early to be concerned with inflation getting out of hand. An inflationary environment, though, is most threatening to cash and bonds and least threatening to stocks since they can absorb inflation more readily. When adjusting returns for inflation, expected real returns strongly favour equities as real ROE for stocks is between 10% and 14%, real returns for bonds are around 3% and real returns for cash are at -1%. The spread between stocks versus bonds and cash is at its widest level in over 30 years and suggests that stocks returns should outpace bonds and cash by reasonable margins.

Asset Allocation and Risk Exposure Modeling

In our last newsletter, we noted that we would touch on risk and exposure budgeting within an asset allocation framework. Most investors focus on return and risk criteria when selecting assets within a portfolio and, since most funds are selected based around benchmarks, investor’s often assume that a strategy’s contribution can only be measured by return net of the benchmark. This is generally an incomplete assessment of the true contribution of a strategy within a portfolio because it does not include other important considerations, such as, an assessment of the relationship between the strategy’s returns versus the rest of the portfolio, the manager’s ability to control a drawdown and the manager’s ability to recover from a drawdown.

At Hillsdale, we have developed the Five Dimensional Mandate©, a process designed to help better structure how investors and managers work together. Simply put, this process helps to increase investor understanding and sharpen manager responsibility. The five dimensions of the mandate are: return, risk, correlation, drawdown and time to recovery. The last three can be categorized as components of risk and allow for a more complete disaggregation of expected volatility.

All five dimensions are critical aspects within our strategy design, stock selection and risk budgeting and monitoring processes. We have taken this framework and integrated in within our Asset Allocation Service. The main intent of this service is to offer clients a customizable assessment of their current portfolio vis—vis their specific objectives and determine if additional risk rebalancing is necessary. As with our strategy design work, we have found that the vast majority of unexpected volatility within a portfolio can be controlled by limiting conflicts amongst the strategies respective correlation, drawdown and time to recovery components.

Regards,

Chris Guthrie and Arun Kaul

Footnotes:

1. returns as at July 27, 2004

2. earnings yield is equal to the inverse of the P/E multiple with the current trailing P/E equal to 18 and 1 divided by 18 equal to 5.6%