Insights

Articles, news and views to help guide you on your financial journey

By Amit Goel, MBA, CFA, CFP

(Head of Private Client Investment Services, Portfolio Manager, Partner)

Your Cash Reserves Can Benefit From Rising Interest Rates

November 2022

The current market environment of high inflation and recession fears has prompted some investors to increase their cash reserves during the short term while they wait for clarity to invest for the long term.

Rising interest rates have provided an alternative option for investors to earn a higher return on their cash savings.

If you would like to benefit from rising rates, I would recommend exploring the following short-term options for investing your cash reserves.

1. High Interest Savings Accounts (HISAs)

2. High Interest Savings Accounts ETFs (HISA ETFs)

1. High Interest Savings Account (HISA)

As the name suggests, a High Interest Savings Account (HISA) provides higher interest for your cash compared to a typical savings account. While the interest rate per account may differ from one bank to another, most investors tend to stay with their existing bank rather than open an account with a new bank.

To take advantage of these competitive interest rates, you can now get access to multiple HISAs directly on your investment platform.

Hillsdale clients can benefit by investing in National Bank's HISA, currently providing a return of 3.5% per annum, the highest rate within its category (1). This can be done within their existing Hillsdale investment accounts.

Since most investors’ bank accounts are also linked to their investment accounts, HISAs can facilitate seamless deposits and withdrawals. While the regular cash transfer process may take two to four business days, you can request same day transfers by using the wire transfer service (2).

The following are some key features of a High Interest Savings Account:

- Security: Covered by the Canada Deposit Insurance Corporation (CDIC) (3)

- Low cost: Zero management fees, no transaction costs to buy or sell

- Liquidity: Can be bought or sold on a daily basis within an existing investment account

- Returns linked to interest rates: Automatically adjusts to the change in interest rates, so if interest rates go up, the published HISA rate will increase. Similarly, if interest rates fall, the HISA rate will decrease.

- CAD & USD currency options available

2. High Interest Savings Account ETF (HISA ETF)

The rising popularity of HISAs is also reflected in the growing investments in HISA-focused Exchange Traded Funds (ETFs). While ETFs are not CDIC insured and incur some transaction fees, they typically hold the investments in deposits at large Canadian banks and hence present a safe option to invest your cash. HISA-focused ETFs are currently providing a net-of-fees yield exceeding 4% per annum. (4)

You can find links to key HISAs (1) and HISA ETFs (4) providers at the end of this article.

Switching HISAs to Longer-Term Investments

Another major advantage of using HISAs or HISA ETFs is that investors can easily switch their cash into longer-term investments when an opportunity arises. We have been helping investors with this process based on their short-term and long-term financial goals. While it is difficult to predict extreme market bottoms, investing for the long-term during down markets can prove to be a rewarding strategy. (5)

(1) HISA offered by National Bank Investments, currently offering highest interest rates as compared with HISAs offered by TD Bank, CIBC, B2B Bank and Equitable Bank (as on 28 November, 2022).

(2) Wire transfer fees and interest charges may apply.

(3) CDIC insures deposits held at a member institution for up to a maximum of $100,000, per separately insured category. For example, deposits held in registered accounts like RRSP, TFSA, RESP are considered to be separate categories and would be insured separately. See CDIC website for more information.

(4) HISA ETFs offered by CI Global Asset Management, Purpose Investments, Evolve ETFs, Horizons ETFs and Ninepoint Partners.

(5) Looking back at 13 occurrences since 1945 when the U.S. stock market (S&P 500 Total Return Index) dropped by at least 20%, investors with a 5-year investment horizon experienced positive returns in all instances. They were well rewarded for taking risk with an average cumulative return of 80% over the next five years. Maximum cumulative 5-year return: 151% (1948–53), Minimum cumulative 5-year return: 21% (2001–06). Past results are not necessarily indicative of future performance. Based on month-end observations. All returns in U.S. dollars.

Giving While Living

December 2019

In spirit of the Season of Giving, I would like to share my thoughts highlighting some key strategies on ‘Giving While Living’. The content has been reviewed by tax professionals at MNP*.

In 2010, 40 of America’s wealthiest families came together to pledge more than half of their wealth to philanthropy. Led by Bill Gates, Melinda Gates and Warren Buffet, The Giving Pledge was a radical shift from traditional charitable giving practices, where the majority of one’s wealth is typically donated just before or after their death. The pledge’s innovative “Giving While Living” strategy emphasizes giving more, earlier in life, to help combat society’s most pressing and profound challenges. This entrepreneurial form of philanthropy can magnify the personal and philanthropic impact of the charitable investment, enabling high-net-worth individuals and families to bring their unique experience and passion to tackle global problems.

Why Give Now

“Giving While Living” encourages an “act now” approach that can yield more meaningful benefits for you, your family and heirs, your community and society as a whole. Donating a portion of your wealth while alive enables you to:

- Address urgent problems and achieve impact on a large scale,

- Bring your unique knowledge, skills and network to support your cause and drive change,

- Explicitly direct your givings towards the charities and causes you most believe in, with the flexibility to shift your focus and approach over time,

- Involve your family and heirs in your long-term vision and prepare them for maintaining your legacy and managing their inheritance,

- Reap financial and tax benefits, while reducing the financial and legal burden on your heirs by establishing your philanthropic and legacy plan while alive and with your heirs’ involvement and,

- Experience greater purpose and meaning in your life by playing an active, integral role in making the world a better place.

Tax Credits for Charitable Donation

Canada has a generous tax credit system to encourage charitable donations, with donations in excess of $200 generating federal + provincial tax credits of 44% to 54% of the amount donated depending upon your income and province of residence.[1] In reality, Canada's tax system allows you to choose to direct your taxes to either your favourite charity, local public school or the Canada Revenue Agency.

When making a donation, it is important to identify qualified organizations, which are registered charities or public organizations that can issue tax receipts. The Canada Revenue Agency (CRA) provides a searchable online database that allows you to confirm if a charity is registered.[2] The CRA also provides a charitable donation tax calculator that allows you to determine your total tax credit, based on your province of residence and your taxable income in a given year.[3]

Important Considerations Before Giving

Before engaging in a “Giving While Living” strategy, you must first ensure that your financial well-being is protected. You should budget enough to support your projected lifestyle as well as a succession plan. A detailed discussion with a qualified financial planner and tax accountant is recommended before embarking on any of the strategies discussed below.

How to Give – Five “Giving While Living” Strategies

There are several strategies that can be employed to give while alive, each with its own unique structure and benefits. A brief overview of a few increasingly popular strategies is described below:

1. Set Up Your Own Charitable Foundation

For those able to make a large donation (for example, over $500k), creating a charitable foundation can be an appealing option. While there are numerous benefits to this strategy, it is also worth considering the administrative, operating, and maintenance costs of managing a foundation, which are more substantial than the other strategies that follow.

Benefits:

- You can shape the long-term vision and direction of the foundation and the distribution of funds to single or multiple causes,

- As private foundations are exempt from taxes, the income earned by the foundation can grow tax-free, allowing for the allocation of larger gifts and,

- You can engage your family in the proliferation and preservation of your (and their) legacy.

2. Donor-Advised Funds (DAF)

If setting up a foundation seems too labourious, a DAF is a similar, simpler approach that allows you to contribute to an established charitable foundation that will manage the investments and administer the grants for you.

Benefits:

- Easy and inexpensive to establish, compared to a foundation, with minimal administrative responsibilities and operating expenses and,

- Just like other strategies, you will receive a charitable tax receipt for the entirety of your donation and you will have continued control and flexibility over the causes your funds support.

3. ‘In-Kind’ Donation of Securities

If you are planning to donate by selling publicly traded securities, bonds or mutual funds that have accumulated capital gains, you should consider giving the donation “in-kind”. This means that you donate the securities themselves, rather than selling them first and donating the post-tax proceeds. An in-kind donation benefits both the donor and the charity.

Benefits:

- You will receive a charitable tax receipt for the fair market value of the securities and you will be exempt from paying tax on the capital gains and,

- The charity will receive a greater donation amount, as the CRA will not levy capital gains tax on publicly donated securities.

4. Charitable Remainder Trust (CRT)

If you intend to set up a trust to pay you and/or your children during your lifetimes and donating the remainder to a charity, a CRT may be the answer. By setting up a CRT, the donor receives immediate tax relief in respect of the contribution. However, the capital contribution stays invested in the trust and the resulting income can be distributed to you and/or to your beneficiaries. The charity will receive the capital contribution of the trust upon the death of trusts beneficiaries.

Benefits:

- The income generated by the trust will provide regular, sustainable income for you and your family,

- You will receive an immediate, present value tax receipt upon creation of the trust and,

- You can determine the charities and causes that the remaining funds will be donated to after your death.

5. Donating Artwork

If you own a piece of artwork that is “certified cultural property”[4], as determined by the Canadian Cultural Property Export Review Board, you have the ability to donate the asset to a designated institution, such as a museum or art gallery, and generate tax benefits.

Benefits:

- You will not pay any taxes on the gift and you will receive a tax receipt for the full appraised value of the gift, as determined by the Board and,

- The artwork can be displayed by the institution and enjoyed by a broader audience.

Closing Remarks

“Giving While Living” is a highly impactful, tax-efficient giving strategy that enables greater personal and societal engagement, fulfilment and proliferation. It should be considered a key part of your financial plan, one that will allow you to use your knowledge, wealth and compassion to create immediate, profound and lasting change in the world. It is your opportunity to take a leadership role in fostering the next generation of engaged and devoted humanitarians. It is something you can begin today by speaking with your financial advisor.

As stated by Laura Arrillaga-Andreessen, founder and president of a renowned philanthropic foundation, and life-long advocate of giving while alive: “Shouldn't you put the same amount of effort into your giving as you might for your for-profit investments? After all, philanthropy is an investment, and one in which lives - not profits - are at stake.”

[*] Ryan Sakauye, CPA, CA, Partner at MNP, provided collaborative efforts on the tax information contained in the article.

[1] Please consult the applicable tax adviser for your province of residence.

It's Time to Convert to a Fixed-Rate Mortgage

March 2021

If you or your family members hold a variable-rate mortgage, it has served you well as interest rates have been declining for almost 40 years. With rates now at historical lows, you should consider switching to a fixed-rate mortgage.

We examine the post-pandemic economic environment to shed some light on where interest rates may be heading.

2020 COVID-19 Effect

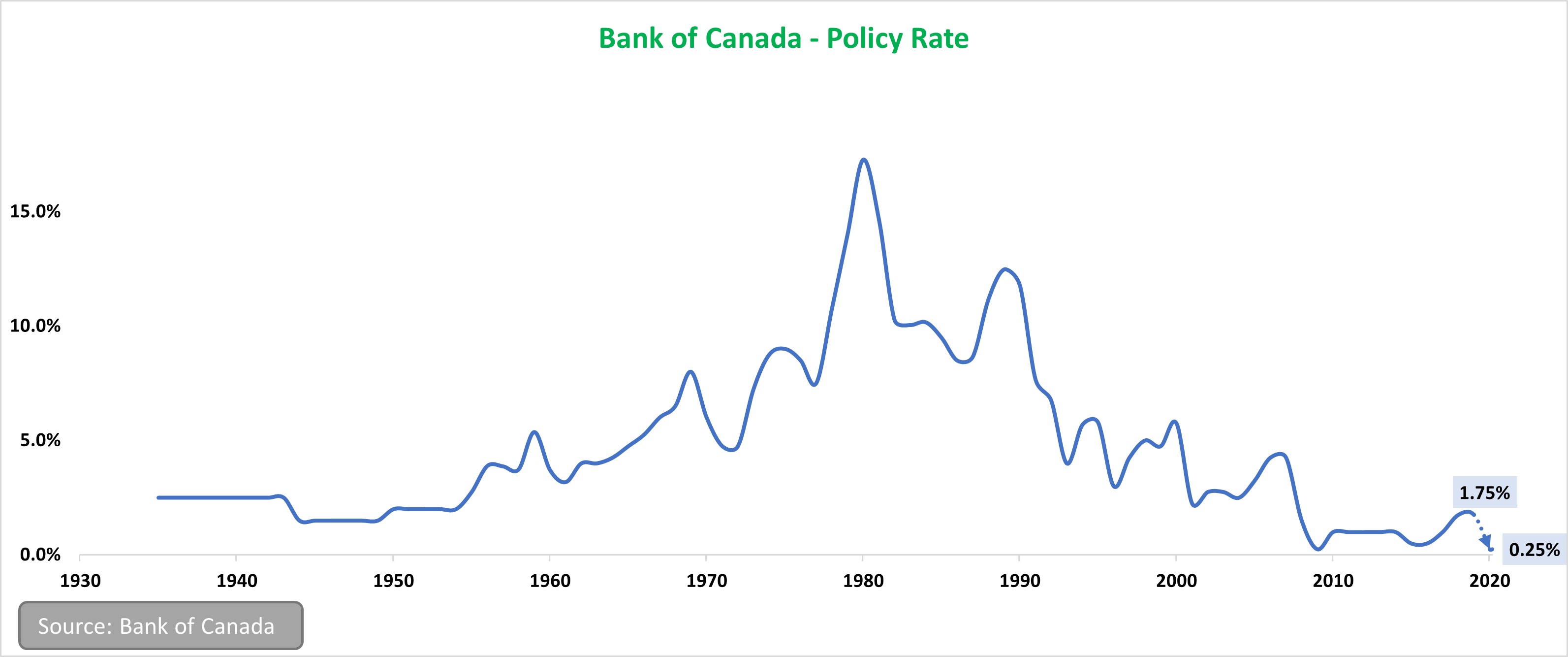

With much of the world in lockdown and economic activity almost at a standstill given the pandemic, central banks aggressively reduced interest rates in 2020 to stimulate consumer and business spending. Bank of Canada reduced its policy interest rates from 1.75% to 0.25%, its lowest-ever level. This translated to a significant reduction in variable-rate mortgage rates.

The Policy rate/overnight is the interest rate at which major financial institutions borrow and lend one-day (or "overnight") funds among themselves; the Bank sets a target level for that rate. This target for the overnight rate is often referred to as the Bank's policy interest rate.

The Policy rate/overnight is the interest rate at which major financial institutions borrow and lend one-day (or "overnight") funds among themselves; the Bank sets a target level for that rate. This target for the overnight rate is often referred to as the Bank's policy interest rate.

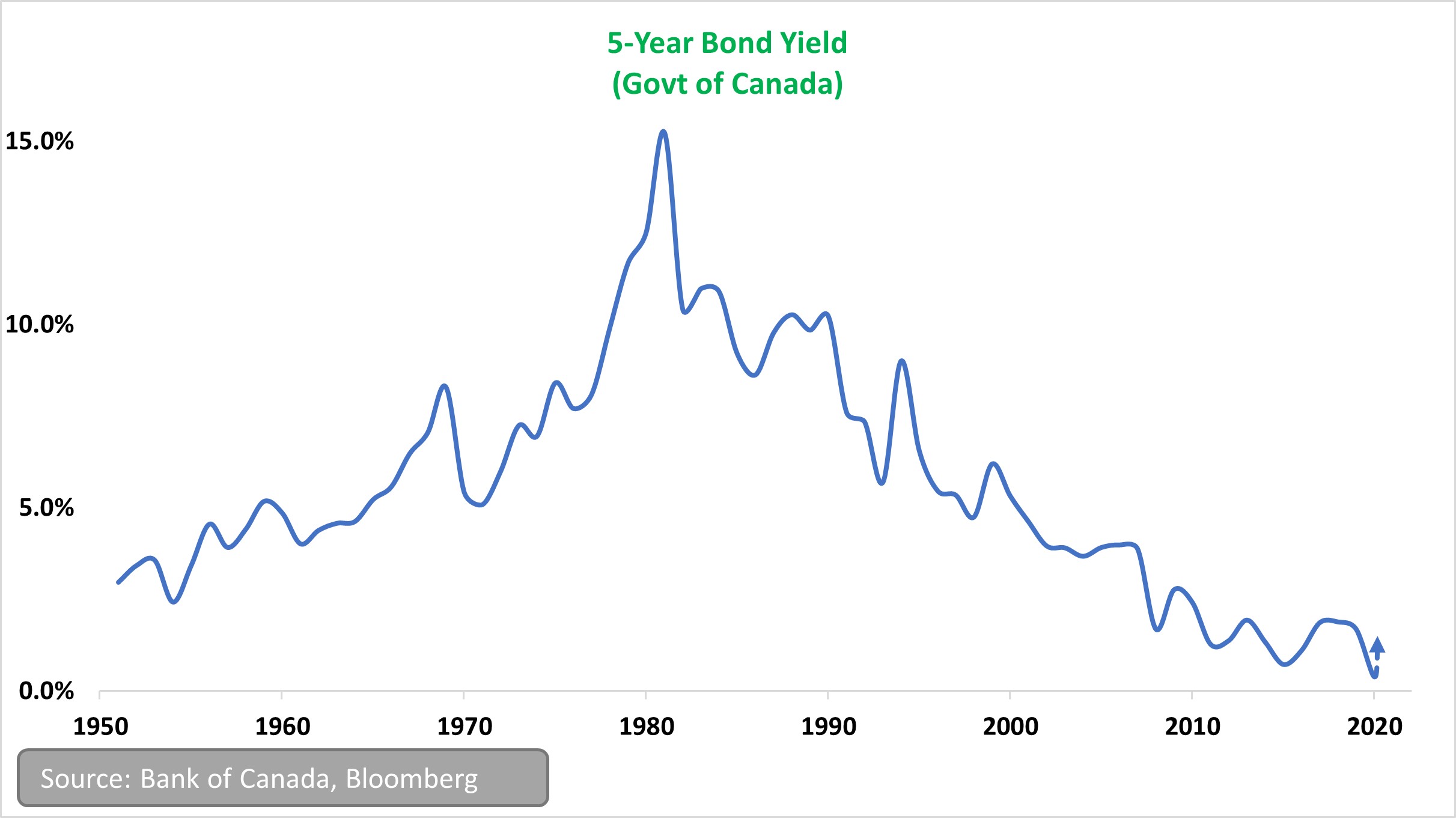

2021 & Beyond: Economic Recovery

Now, the economy has stabilized, and vaccinations are helping bring the world closer to normalcy. As the economy recovers, inflationary pressures may start to build up and central banks may need to increase interest rates to help manage inflation. This effect has already started to reflect in the bond markets, where 5-year bond rates have started to inch up, after falling to an all-time low in 2020.

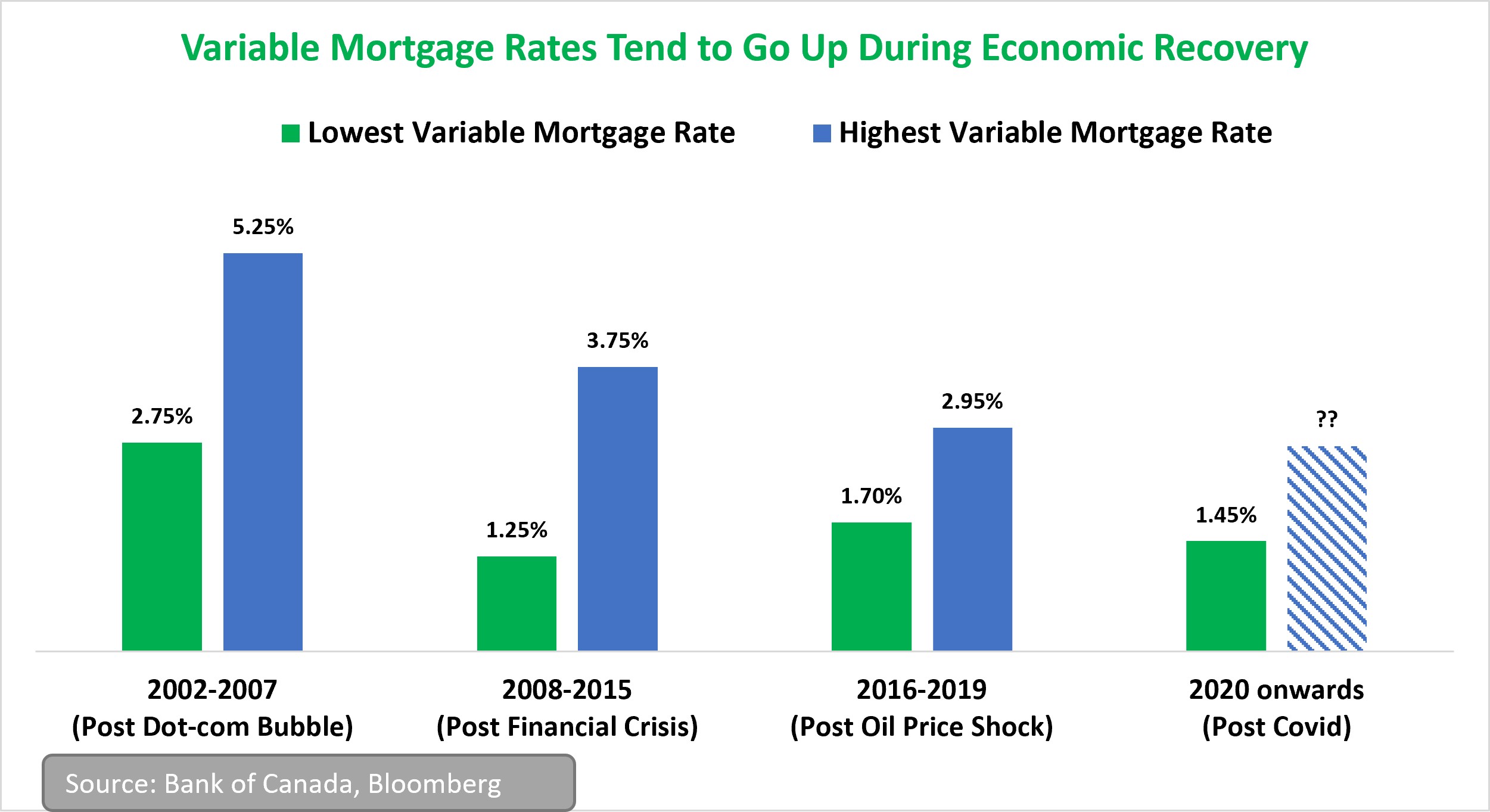

History shows that as the economy recovers from a major event, variable mortgage rates rise substantially. The chart below highlights three such economic cycles in the past two decades where variable rates have risen amidst an economic recovery. Today’s pandemic is the fourth such event and, while we don’t have a crystal ball, the pattern should continue and variable mortgage rates will jump as the economy rebounds

Thinking ahead, it may be a good time now to lock-into a 5-year fixed-rate mortgage, while they are still at lowest levels (since 1950). Typically, there's no penalty to switch from a variable-rate mortgage to a fixed rate mortgage.

You should discuss the suitability and effectiveness of variable-rate versus fixed-rate mortgages with your mortgage advisor or other relevant specialist. If you’d like more information, we will be happy to share our research and market data.

Russia Invasion: Market Impact

February 2022

Financial markets (across equities, bonds, commodities and gold) have been adjusting to the reality of the Russian invasion of Ukraine.

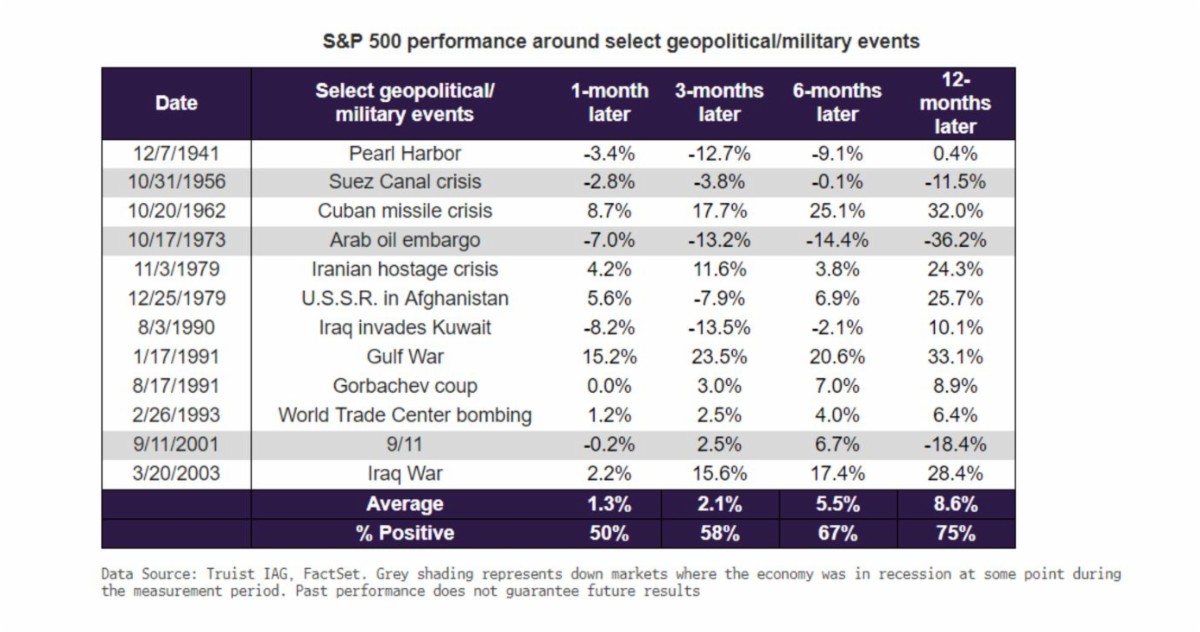

Recent history shows that the markets generally recover quickly from geopolitical and military events. If there is one lesson from looking collectively at past geopolitical conflicts (and they are all different to be sure), it is that they usually prove to be noise in the bigger picture that is ultimately shaped by the economic and monetary policy cycles.

Looking ahead, the major risks to markets are the length of the conflict and if it expands beyond Russia and Ukraine. If the war is brief with narrow sanctions, the market impact could be short-lived, as it was in prior regional wars. However, if the conflict lasts longer, there could be higher geopolitical uncertainty and market turbulence.

Your Portfolio

With investors ‘buying the dip’ yesterday and today, the underlying market assumption seems to be that the current geopolitical incident will have limited impact. We continue to remain cautious, but do not suggest any immediate change in your investment plan, as your portfolio is well designed in line with your financial goals, market opportunities, time horizon, risk profile and future cash flow requirements. Our adaptive “Snake-in-the-Tunnel” process has ensured that market movements have a limited impact on your financial freedom and lifestyle.

Amongst all the market upheaval, Canada has proven to be a relatively good hiding place. Energy directly accounts for 15% of the S&P/TSX Index, versus 3.5% for the S&P 500 Index. Canadian equities have also proven to perform relatively well against inflationary forces, helped by its larger exposure to commodities.

By Amit Goel, MBA, CFA, CFP

(Head of Private Client Investment Services, Portfolio Manager, Partner)