We are driven by curiosity. We have a penchant for seeking out new experience, original knowledge and candid feedback. Read this section for our thoughts, our insights, and a few opinions.

Stress Testing the Canadian Aggressive Hedge Fund for Rising Interest Rates

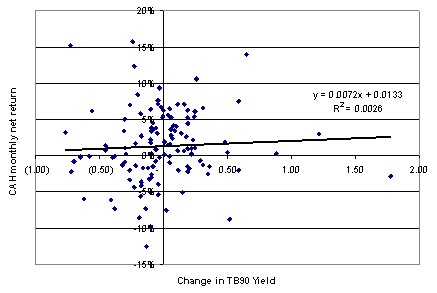

Hillsdale’s return forecasts, risk control and portfolio construction methodologies were simulated in a proprietary test environment from January 1994 to December 2003. Monthly returns net of the TSX Composite Index and of disturbance costs were regressed against coincident changes in Government of Canada 3 month Tbill rates. As seen below, the strategy generates average monthly net returns of 1.33% with a small positive bias to rising interest rates.

Aggressive Hedge Net Returns vs. 3 Month T-Bills

Returns were then separated into periods of either falling or rising rates. Monthly returns during periods of rising rates were re-combined (‘bootstrapped’) into a single return stream. During months where T-bill rates increased (53 observations), the strategy generated average monthly net returns of 1.95% with approximately 72% of the months being positive.

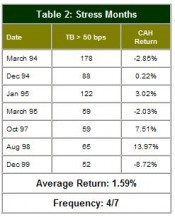

Periods of rising interest rates were then further clustered into “normal” periods, defined as a monthly increase of between 20-50 bps (15 observations) and “stress” periods, defined as a monthly increase of greater then 50 bps (7 observations).

During periods of “normal” interest hikes the strategy generated an average monthly net return of 1.85% with approximately 67% of the months being positive. During periods of “stress”, the strategy generated an average monthly net return of 1.59% with approximately 57% of the months being positive. Individual months and returns are shown in Tables 1 and 2.

All Hillsdale strategies are designed over 20-30 years of rigorous in and out of sample testing. Specific attention is paid to avoid the use of ‘fat tail’ forecast variables which often arise from the mining of a single regime environment or from the use of purely linear techniques. The Canadian Aggressive Hedge Equity fund is constructed to be neutral to most known macro factors including yield curve shifts and changes in credit spreads and inflation. While we recognize that a given macro environment is only a small contributor to the net returns of this strategy, it is important to underline that a rising interest rate environment has rarely negatively impacted the strategy and that through all aggregate periods of rising rates, the Canadian Aggressive Hedge strategy provided returns in excess of the TSX Composite Index.