We are driven by curiosity. We have a penchant for seeking out new experience, original knowledge and candid feedback. Read this section for our thoughts, our insights, and a few opinions.

Canadian Stock Market Inefficiencies

June 2005

Canada is an excellent market to manage long/short equities, in part because of its structural inefficiencies.

Canadian listed stocks turnover one half to one fifth of the rate of US stocks, allowing more time to capitalize on structural inefficiencies

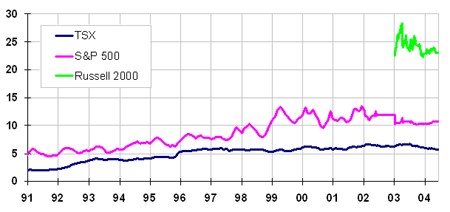

Since 1991 stocks comprising the TSX Composite (approx 250 names) have turned over their outstanding shares at a rate of 2 to 5% per month, equating today to an average hold period of approximately 20 months (1.7 years).

Canada vs U.S. – Average Monthly % Turnover

This graph illustrates the historic share turnover rates of Canadian vs. U.S. listed stocks as represented by the TSX Composite, the S&P 500 and the Russell 2000.

Source: CPMS Computerized Portfolio Management Services Inc.

The equivalent number for the S&P 500 today is 10% per month, equivalent to a 10 month hold period. The Russell 2000, where many active hedge managers play, currently turns itself over a startling 25% per month (five times Canadian stocks). This is an average hold period of four months.

To determine the optimum level of turnover for its long/short strategies, Hillsdale developed a proprietary 20 year simulation environment with data frequency ranging from intra-day to weekly to annual. Using this unique resource, Hillsdale is able to find the optimal tradeoff of key fundamental stock factors and turnover to generate the best return forecast, for a specified level of risk.

Hillsdale’s relatively shorter trading cycle allows it to fully exploit Canadian market inefficiencies

Hillsdale’s Canadian Aggressive Hedged Equity fund, with an annualized risk budget of 10-12%, employs 8-10 factors and turns over its positions, on average, every 6 months. This has enabled it to generate superior performance in a market where the average holding period is 1.7 years.

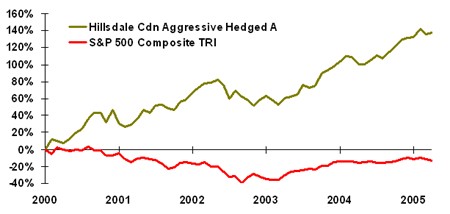

Hillsdale CDN Aggressive Hedged A