We are driven by curiosity. We have a penchant for seeking out new experience, original knowledge and candid feedback. Read this section for our thoughts, our insights, and a few opinions.

2004 Market Outlook

After suffering their longest and deepest trough or drawdown since before World War II, US equity markets rallied strongly in 2003. The S&P 500, which captures more than 80% of the U.S. market, rose 27%, its best year since 1993. Small companies, as measured by the Russell 2000 index, rose 45%. Their best year since 1991. Each was outpaced by the NASDAQ, which led all markets, rising 50% and posting the second best performance in its history (only 1999’s tech-mania return of 86% was better). In Canada, the TSX following two down years and its deepest draw down since 1973-74, saw a gain of 24%, its best year since 1999.

In fact, 2003 was as an excellent year for every asset class. From domestic equities to international equities (MSCI EAFE, which measures stock performance outside North America, was up 35%) including Japan (+Nikkei +24%) to emerging markets (MSCI EMF +49%) through to bonds (SMU, Scotia Capital Markets Bond Universe Index +7%) and from real estate (+7%) to commodities (Gold +21%, CRB, Commodities Research Bureau Index +10%) strong returns were posted throughout. The only exceptions were the US government long bond (S&P Long Bond Index -2%) and the US dollar (falling -8.9% on a trade weighted basis). Across the asset class spectrum, this was the broadest advance since 1985.

While the equity returns were impressive, the indices still remain below their high water marks. Both the S&P 500 and the S&P TSX would need to gain an additional 35% to reach their previous peaks and the NASDAQ would need a gain of more than 130% to attain its previous peak.

Forecasts for 2004

Given the strength of the stock market rally since March, along with signs that both the U.S. and world economy are gathering speed, prognosticators are touting that this year will be an up year for the markets. According to predictions in Barron’s and Business Week, a majority of forecasters are predicting that US markets will gain between 0% and 10%. At the extremes, less than 5% are predicting gains of more than 20% and less than 5% are predicting losses of more than 20%. The consensus forecast is supported by key financial indicators such as continued growth in earnings, favourable valuation levels, low short term interest rates and excess liquidity.

Market Drivers in 2004

Growth in earnings by U.S. corporations in 2002 fell to levels comparable to the recessions of 1991, 1981 and 1977. After a year of decline, earnings bounced back in 2003, growing on average 20%. For 2004, analysts’ are predicting that earnings will grow 15%.

In Canada, the decline in earnings growth was not as severe as in previous recessions, nor was the bounce back in 2003 as spectacular as in the U.S. For 2004, analysts are predicting growth in corporate earnings of 17%

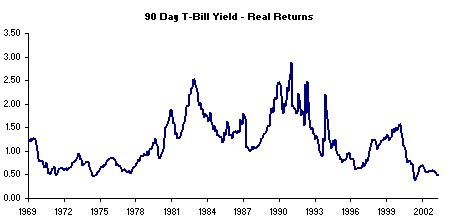

Low short term interest rates make stock prices attractive. A cash investment in short-term US government bills yields 1% and with inflation just below 2%, real returns from cash are negative. Real returns from cash are at their lowest levels in 20 years and do not provide any form of capital preservation.

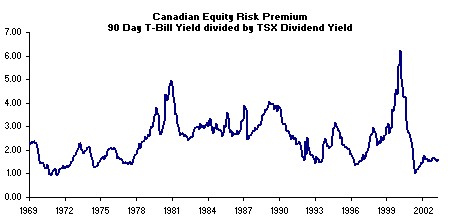

The lacklustre outlook for “safe” assets held in money market instruments makes stocks appealing. S&P 500 stocks are trading at 18 times their projected earnings for 2004. While the price/earnings ratio remains high by historical standards, a yield of 5.5% – the fact that these stocks will earn 5.5% on every dollar of investment – is very favourable when compared to short-term money market yields of only 1%. At this level, the US stock market, as measured by the earnings yield to cash yield ratio is at its cheapest level in over four decades. Short-term investment rates are also at their lowest level in four decades. U.S. Federal Reserve Board chair Alan Greenspan has said that the Fed intends to maintain short-term interest rates at low levels for a ‘considerable period’. Though most investors now expect rates to begin to rise at some point this year, there remains considerable disagreement as to when and how fast rates will rise.

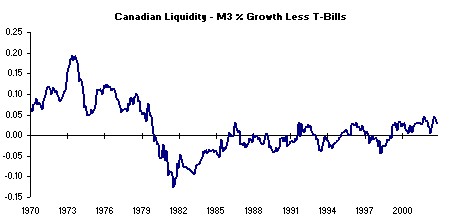

While US stock valuations remain favourable, an even bigger aid for stock markets right now is the excess liquidity in the system. The Fed, by maintaining its aggressive monetary policy, is now pumping more cash into the system than at any time since the late 1970s.

Stock markets in Canada are also being helped along by low short term interest rates. A cash investment in the Canadian money markets yields just over 2% and with inflation currently just below 2%, real returns from cash are less than 1%. As noted in the graph below, real returns available from cash are at their lowest levels in 20 years. After adjusting for taxes, cash returns do not provide any form of capital preservation.

Canadian price/earnings ratios for projected 2004 earnings are running at 17 times stock prices. While the multiple is reasonable compared to historical standards, an earnings yield of 6% is very favourable as against cash yields of 2.75%. As the graph below indicates, Canadian stocks, as measured by the earnings yield to cash yield ratio are at their lowest prices since the late 1970s.

With the Canadian dollar appreciating against the US dollar by 18%, its biggest one year gain ever, and a 150 basis point spread between Canadian and US cash rates, so that income investors can get a yield of 1.50% more than what U.S. Treasuries are paying, the Bank of Canada still has room to continue lowering rates again should it chose to. This should lend further support to stocks in the near term.

While the Bank of Canada has not been as aggressive as the US Fed in its stance on interest rates, it has nonetheless been more than accommodative. As the graph below shows, excess liquidity, as measured by growth of the money supply net of T-bills, is running at its highest levels since 1980.

Given earnings growth expectations, current profitability and valuation levels, we can reasonably expect that the TSX will gain 10% to 15% in 2004.

Scandal

The fundamental drivers for equity returns continue to look positive in sharp contrast to the seemingly endless flow of scandals that continues to taint publicly traded companies and the investment industry. In the corporate corner, following earlier revelations from Enron, WorldCom, Tyco, Adelphia, Rite Aid and Xerox, 2003 saw additional disclosure of improprieties and accounting irregularities at Sprint, Bristol Meyers, Qwest, Tyco again, Boeing and European based firms, Ahold, Vivendi and Parmalat and Canadian based Hollinger. Even the NYSE has been tarnished by allegations of executive improprieties and improper trading by its floor specialists.

Within the investment industry, several brokerage houses and mutual fund companies were accused of breach of fiduciary duty and fraud for engaging in market timing and late trading. Brokers at Prudential and Merrill Lynch, money managers at Putnam, the founder of Strong Mutual Funds and both founders of Pilgrim Baxter all stepped down or quit under allegations of improper trading. Alliance, a mutual fund company, even went as far as agreeing to reduce its management fees by 20% for five years to settle allegations that it allowed improper fund trading.

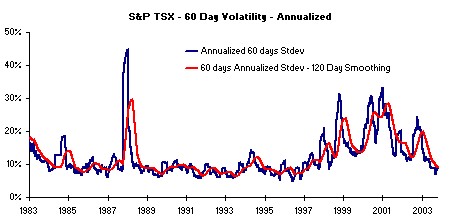

Remarkably, despite the turmoil and nefarious behaviour, investors can take comfort from the fact that, not only did the market go up during this period, but that volatility levels actually declined. As the graph below indicates, volatility first spiked with the Asian currency crisis of October 1997 and experienced successively higher peaks with the Russian bond crisis of August 1998 and the Nortel-mania peak of September 2000.

Since the U.S. stock market bottom in October 2002, volatility levels have been steadily subsiding. They are now close to what they were between 1980 and 1997, before the stock market bubble. While it is too early to confirm that these lower levels of volatility can sustained, it is encouraging to note that volatilities are at a six-year low.

Risks remain

What would abridge the current equity rally? Certainly it is easy to point to many risks, such as, the ongoing wars in Iraq and Afghanistan, the twin US deficits, the march of regulators, proposed changes in accounting rules that would force expensing stock options, a rise in short term rates, a rise in long term rates, return of inflation or the continued depreciation of the US dollar, we feel that it is most important to address these issues through the lens of a risk and exposure budget.

To our existing clients we offer customizable risk and exposure budgeting techniques. Within the Hillsdale product line-up, our firm now offers six distinct strategies, each designed with specific return, risk and market exposure benchmarks. In addition to our product line-up, we also offer Risk Exposure Modelling services. This service includes customized asset allocation planning, risk and exposure budgeting and risk-scenario analysis to help investors’ better position their portfolios.

In our next newsletter, we will focus on the use of risk and exposure budgeting within an asset allocation framework. Given the events of the past few years, the current risk environment, low real returns from bonds and zero real returns form cash, we feel that investors are well advised to spend some time learning and understanding how proper asset allocation and portfolio construction can become key aspects of a successful asset management program.

Regards,

Chris Guthrie and Arun Kaul

Footnotes:

1. as measured by the Toronto Real Estate Board (TREB)

2. as of Dec. 31 2003, based on month end prices data