From time to time, Hillsdale is in the news. Our partners often speak at conferences or other events, and our accomplishments are covered in the financial media.

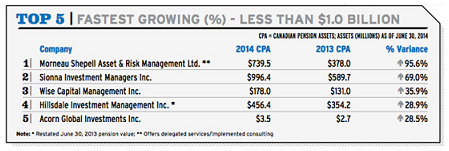

Hillsdale Makes 2014’s Top 5 List of Fastest Growing Money Managers

2014 Top 40 Money Managers Report: Fear Factor

Yaldaz Sadakova | November 4, 2014

To preserve recent gains, pension funds are diversifying their assets—and facing the risk issue head-on

What if the best way to control risk was to embrace it?

After seeing asset increases and funded status improvements over the past two years, Canada’s pension funds are now focusing on keeping their gains. They know they can achieve this through de-risking—but, for many of them, giving up returns in the current environment induces anxiety.

So, in an effort to extract much-needed yield while controlling risk at the same time, DB pension funds are adding more opportunistic types of fixed income to their portfolios and increasing their alternative holdings.

“They’re taking a good hard look at the risk side of the equation and making sure that they aren’t assuming too much risk and that they’re positioned for future volatility that we may see in the marketplace,” says Duane Green, head of the Canadian institutional group at Franklin Templeton Investments (No. 15 on the Top 40 Money Managers list).

The issue of risk—when and how, exactly, to take it on—is a tricky one. Risk management usually comes to the forefront when pension plans are in deficit, but that’s also when it’s most difficult—or least affordable—to actually take risk off the table, says Ken Choi, director of investment consulting at Towers Watson. “Conversely, when times are good and plans are in surplus, that’s when plan sponsors have tended to become perhaps a bit complacent about risk.” But it’s the good times that are best for de-risking, Choi explains. Most of Canada’s DB pension plans are currently either fully funded or close to fully funded. “Now is the time to not be complacent about risk because you can afford to do something that you couldn’t do before,” he adds.

So what are pension funds and their portfolio managers doing to manage risk?

Afraid of the Dark?

Historically, pension funds have turned to fixed income in an effort to de-risk. Many pension plans are still increasing fixed income allocations as a de-risking strategy, but it’s not as easy today compared with 10 years ago, when interest rates were higher.“The challenge is that, 10 years ago, you could almost have a free lunch,” says Choi. “You could hedge your liabilities and get a decent return while doing so.”

In today’s low interest rate environment, if investors want to hedge their liabilities with more fixed income or with longer duration fixed income, they will get lower returns, Choi explains.

“Investors are desperate to try and find yield somewhere,” says Marija Finney, senior vice-president and head of institutional sales and service with BMO Global Asset Management (No. 39). Enter opportunistic fixed income.

To get both yield and hedging out of bonds at a time of exceptionally low interest rates, pension funds are turning to more opportunistic products such as high-yield corporate bonds (also known as junk bonds), other kinds of distressed debt, emerging market debt and catastrophe bonds (high-yield instruments issued by insurers, intended to raise money in the event of natural catastrophes). Some of these fixed income offerings, such as distressed debt and catastrophe bonds, are classified as alternatives.

High-yield types of fixed income can be much less liquid but real alpha generators, adds Green.

Peter Muldowney, senior vice-president of institutional strategy with Connor, Clark & Lunn Financial Group (No. 7), agrees. “If you can get a manager who can add 100 basis points on something, then that added value is quite significant.” Also, he notes, these opportunistic products are not as sensitive to interest rate changes as traditional bonds are.

To read the entire article, download a copy here.